Nigeria Financial Services Shared IT Infrastructure & IT Standards Programme

Re-prioritised Industry IT standards

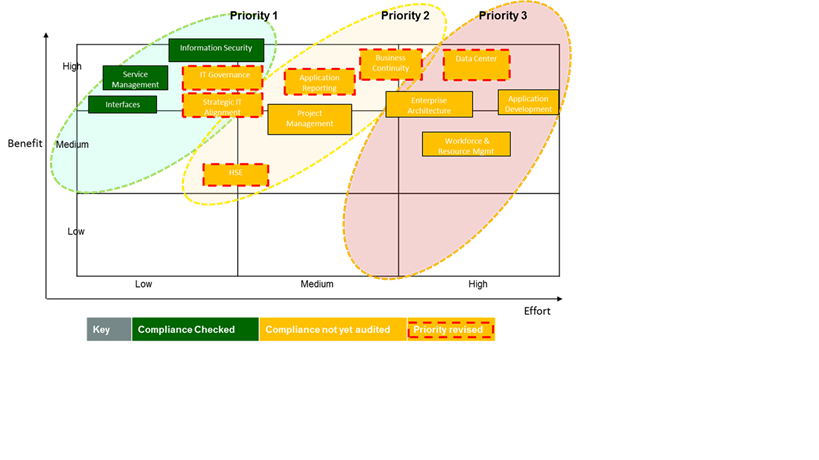

The IT standards are prioritized based on Effort (ease of implementation of a standard is a function of the efforts required to implement, the implementation costs as well as the duration and risks of implementation) and Benefits (the impact of implementation on the business and on the end user, the benefits derivable as well as the time it takes to begin deriving value from the implementation of the standard)

Figure 1 - IT Standards Prioritization

The IT standards areas prioritisation is as follows:

Priority 1 Standards:

- IT Governance

- Strategic IT Alignment

- Service Management

- Interfaces

- IT Security

Priority 2 Standards

- Project Management

- Application Reporting

- Business Continuity Management

- Health, Safety and Environment

Priority 3 Standards

- Enterprise Architecture

- Application Development

- Workforce and Resource Management

- Data Centre

The Standards shall be implemented using a continuum approach such that initial implementations would target the agreed maturity level 3 and subsequently improved to include higher maturity levels if desired by the institution

Useful links

- Overview and Summary IT Standards for the Nigerian Financial Services Industry

- Target Maturity Levels

- Expected Impacts and Benefits

- Re-prioritised Industry IT standards

- IT Standards Adoption Roadmap

- IT Standards Governance and Interaction Model

- CBN IT Standards Council ToR

- IT Standards Blueprint for Deposit Money Banks (DMBs)

- IT_Standards_Blueprint for Payment Solution Providers (PSPs) and the National Microfinance Banks (NMFBs)

See Frequently

Asked Questions on the IT Standards Blueprint

Flickr

Flickr Instagram

Instagram LinkedIn

LinkedIn