Nigeria Financial Services Shared IT Infrastructure & IT Standards Programme

IT Standards Governance and Interaction Model

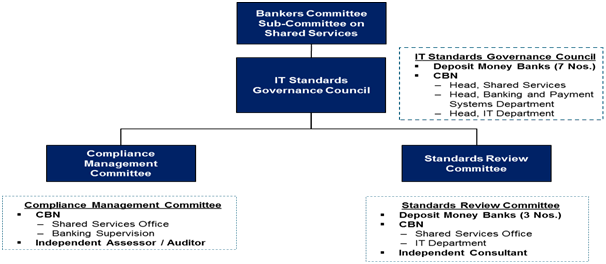

The purpose of the IT Standards Governance Model is to establish a framework which will facilitate the adoption of IT standards as well as management of the standards lifecycle within the Nigerian Banking Industry.

Guiding Principles and Policies

The following guiding policies have been defined for the administration of IT standards in the Nigerian Financial Services Industry:

- Standards must be internationally acknowledged standards or a local variant

- All Financial Services organizations and external IT service providers / operators shall be required to comply with IT standards

- Governance Council to oversee IT standards adoption, implementation and management within the industry

- Governance Council reports periodically to the Bankers’ Committee on status and compliance with approved standards

- Membership of the IT Standards Governance Council includes nominees of Deposit Money Banks and the Central Bank of Nigeria

- Independent assessment of Banks’ internal processes and test controls will be the basis of determining compliance

- Periodic audits will be carried out annually on Banks’ processes and controls to ensure compliance.

IT Standards Governance Model and Processes

In order to embed the adopted IT Standards within the Nigerian Financial Services industry, it is expedient to develop a binding framework of processes and procedures that will guide the introduction of new standards, review or modification of existing ones, and complete withdrawal of obsolete or irrelevant standards, thereby maintaining relevance and ensuring continuity by both CBN and other stakeholders.

Establishing and documenting pre-defined roles and responsibility matrices extend the clarity of governance model organization charts by providing more precision in the allocation of decisions to and by authorized personnel

This section details the governance model and processes for the Financial Services Industry and IT Standards Council.

The IT Standards Governance Council will be supported by (2) working committees namely:

- Compliance Management Committee

- Standards Review Committee

The IT Standards Governance Council is depicted in the picture below:

Figure 1 - IT Standards Governance Structure

Roles and Responsibilities

Designation |

Roles and Responsibilities |

IT Standards Governance Council |

|

Compliance Management Committee |

|

Standards Review Committee |

|

Useful links

- Overview and Summary IT Standards for the Nigerian Financial Services Industry

- Target Maturity Levels

- Expected Impacts and Benefits

- Re-prioritised Industry IT standards

- IT Standards Adoption Roadmap

- IT Standards Governance and Interaction Model

- CBN IT Standards Council ToR

- IT Standards Blueprint for Deposit Money Banks (DMBs)

- IT_Standards_Blueprint for Payment Solution Providers (PSPs) and the National Microfinance Banks (NMFBs)

See Frequently

Asked Questions on the IT Standards Blueprint

Flickr

Flickr Instagram

Instagram LinkedIn

LinkedIn