Reserve Management

1. What are Foreign Exchange Reserves?Foreign exchange reserves are assets held on reserve by a monetary authority in foreign currencies. These reserves are used to back liabilities and influence monetary policy. They include foreign banknotes, deposits, bonds, treasury bills and other foreign government securities. These assets serve many purposes but are most significantly held to ensure that a government or its agency has backup funds if their national currency rapidly devalues. Foreign exchange reserves are also called international or external reserves.

According to the International Monetary Fund (IMF), “International reserves (or reserve assets in the balance of payments) are those external assets that are readily available to, and controlled by a country’s monetary authorities. They comprise foreign currencies, other assets denominated in foreign currencies, gold reserves, special drawing rights (SDRS) and IMF reserve positions. These reserves may be used for direct financing of international payments imbalances, or for indirect regulation of the magnitude of such imbalances via intervention in foreign exchange markets, in order to affect the exchange rate of the country’s currency”.

Underlying the concept of reserve assets are the notions of “control,” and “availability for use,” by the monetary authorities. Official reserve assets are therefore different from other foreign currency assets that are not available to or within the control of the monetary authorities.

The foreign reserve holding behavior of developing countries differs in some ways from that of advanced countries. For one thing, the developing countries hold more reserves. Many studies have found that reserves, sometimes expressed as a ratio to the money supply and sometimes as a ratio to short-term debt, would have been a useful predictor of the emerging market crises of the 1990s.

Consequently, after the emerging market crises of the 1990s, the traditional rule of thumb that developing countries should hold enough reserves to equal at least three months, of imports was replaced by the “Guidotti rule.” This guideline determined that developing countries should hold enough reserves to cover all foreign debt that is short-term or maturing within one year. Most emerging market countries worked to increase their holdings of reserves, typically raising the Guidotti ratio of reserves to short-term debt from below one to above one. The motive was precautionary, to self-ensure against the effects of future crisis.

2. Reserve Management a) What is Reserve Management and why is it important?According to the IMF, Reserve management is a process that ensures that adequate official public sector foreign assets are readily available to and controlled by the authorities for meeting a defined range of objectives for a country or union. In this context, a reserve management entity is normally made responsible for the management of reserves and associated risks. Typically, official foreign exchange reserves are held in support of a range of objectives including:

- support and maintain confidence in the policies for monetary and exchange rate management, including the capacity to intervene in support of the national or union currency;

- limit external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed and in doing so;

- provide a level of confidence to markets that a country can meet its external obligations;

- demonstrate the backing of domestic currency by external assets;

- assist the government in meeting its foreign exchange needs and external debt obligations; and

- maintain a reserve for national disasters or emergencies.

Managing external reserves is one of the core mandates of the Central Bank of Nigeria (CBN) as stipulated in Section 2 (c) of the CBN Act of 2007. The Act vested the maintenance and management of Nigeria’s external reserves on the CBN in order to safeguard the international value of the Naira. In addition, it is to maintain confidence in Nigeria’s monetary and exchange rate policies, as well as provide confidence to the international community that the country is able to meet its external obligations. The CBN through interventions in the foreign exchange market supports monetary policy implementation by maintaining exchange rate stability and liquidity management.

c) The Broad Objectives of Reserve ManagementThe objectives of external reserves management in Nigeria are:

- Safety - To ensure the preservation of capital

- Provision of adequate liquidity to ensure that reserves are readily available to finance day-to-day official transactions and meet unforeseen needs; and

- Earning returns within tolerable risk limits

The CBN Act of 2007 provides that the Bank shall maintain a reserve of external assets consisting of all or any of the following:

- Gold coin or bullion;

- Balance at banks outside Nigeria where the currency is freely convertible and in such currency, notes, coins, money at call and any bill of exchange bearing at least two valid and authorized signatures and having maturity not exceeding ninety days exclusive of days of grace;

- Treasury bills having a maturity not exceeding one year issued by the government of any country outside Nigeria whose currency is freely convertible;

- Securities of, or guarantees by, a government of any country outside Nigeria whose currency is freely convertible provided such securities shall mature in a period not exceeding ten years from the date of acquisition and are of such investment grade as may be determined by the Board from time to time;

- Securities of, or guarantees by international financial institutions if such securities are expressed in currency freely convertible, in the form of investment grade assets as may be determined by the Board and maturity of the securities shall not exceed five years;

- Nigeria’s Gold Tranche in the International Monetary Fund (IMF);

- Allocation of Special Drawing Rights (SDRS) made to Nigeria by the IMF;

- Investment by ways of loans or debenture in an investment bank or development financial institutions within or outside Nigeria for a maximum period of five years, in so far as-

i. The amount invested is not more than 5% of the total reserves;

ii. The reserve level at the time can sustain twenty-four months of import; and

iii. The loan or debenture is in foreign currency:

Provided the investment bank or development financial institution referred to in paragraph (h) carries such a rating by rating agencies as may be prescribed from time to time by the Bank; and

Such other securities and investments as may be approved from time to time by the Board:

Provided they are liquid foreign currency assets that are of investment grade in the form of freely convertible currencies.

3. Ownership Structure of Nigeria’s External ReservesNigeria’s external reserves by virtue of statute are segregated into three distinctive portions, namely the CBN, the Federal Government of Nigeria (FGN) and Federation reflecting ownership of the reserves.

Central Bank of Nigeria

This arises as the Bank receives foreign exchange inflows from crude oil sales and other sources of revenue on behalf of the government. Such proceeds are purchased by the Bank and the Naira equivalent credited to the Federation account. These proceeds are shared each month, in accordance with the constitution and the existing revenue sharing formula. The monetized foreign exchange, thus, belongs to the CBN. It is from this portion of the reserves that the Bank conducts its monetary policy and defends the value of the Naira.

Federal Government of Nigeria

It consists of funds set aside by the FGN to finance its obligations and to which the CBN has no discretion. These funds represent either funding from government savings, grants, recoveries, or bilateral cooperation earmarked for specified purposes or projects.

Federation

It consists of sterilized funds (un-monetized) held in the excess crude and petroleum profit tax (PPT)/Royalty accounts belonging to the three tiers of government. This portion has not yet been monetized for sharing by the federating units. These are essentially the Government’s savings of excess proceeds of crude oil, (PPT) and oil royalty.

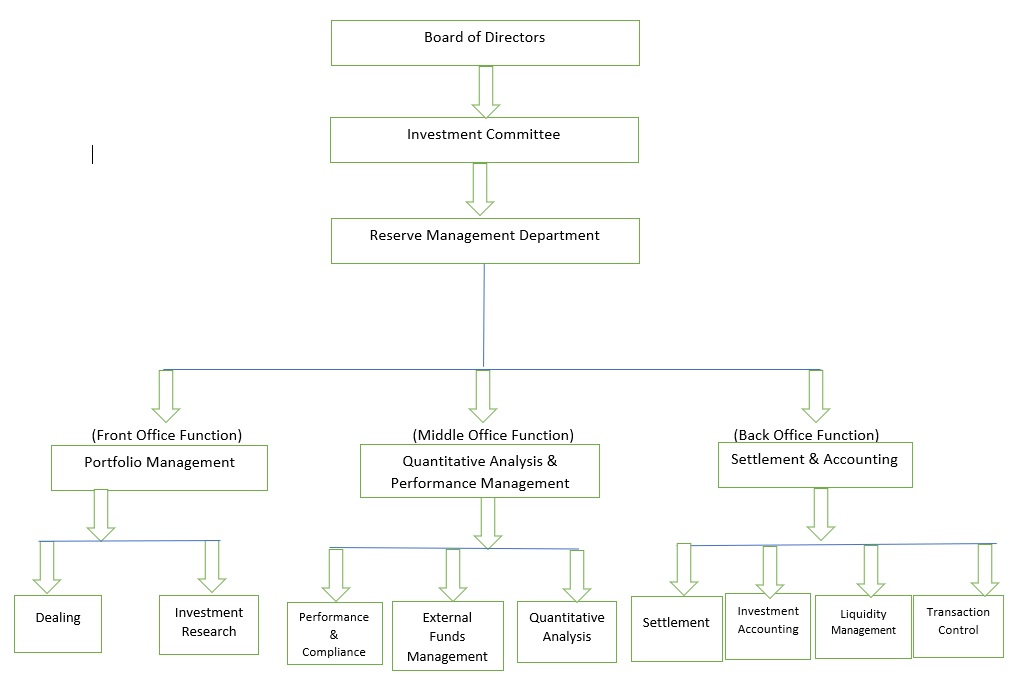

4. CBN Reserve Management Governance Structure

The Board of Directors

The Board of Directors has the overall responsibility for formulating reserve management policies consistent with the provision of the CBN Act. In addition, it carries out the following responsibilities:

- Approval and periodic review of the external reserves investment policy;

- Periodic review of performance of the external reserves portfolio;

- Establishing the content, form and frequency of communiqués to the public regarding the management of external reserves, for the purpose of transparency.

Investment Committee

The Board has delegated to the Investment Committee the oversight responsibility of the management of the external reserves. The responsibilities of the Investment Committee include:

- To monitor and manage the external reserves, making sure that the country makes optimal revenue from the reserves;

- Initiate policies towards efficient management of external reserves for the consideration of the Committee of Governors and the Board; and

- Make periodic reports to the Board on matters concerning Reserve Management

Reserve Management Department

The Reserve Management Department as a business unit is saddled with the responsibility of day-to-day management of the reserves.

This portfolio is being managed in compliance with the Investment Guidelines approved by the Board of the Central Bank of Nigeria. The Investment Guidelines provided explicitly the risk appetite of the Bank in the followings areas to guide the managers: Investment Objective, Benchmark and Performance Evaluation, Risk Budget, Eligible Currencies and Currency Limits, Eligible Investments, Duration Limits, Liquidity Constraints and, Credit Risk.

The program is reviewed periodically.

Accountability and Disclosure

The CBN is accountable to the Presidency and the National Assembly in its statutory responsibilities. In addition, it has continued to provide relevant information to the public on its activities. These are done through publications such as annual reports, CBN half year economic reports, financial stability report and statistical bulletins.